📘 Comprehensive Guide to Vietnam’s New Tax Management Model for Individuals & Household Businesses (Updated 2025)

Vietnam’s tax management model for individuals and household businesses has undergone major updates under Decision 3389/QĐ-BTC (dated 06/10/2025). These changes aim to increase transparency, reduce tax evasion, and ensure fair tax obligations across sectors.

This comprehensive guide provides a fully translated and expanded analysis to help you understand and comply with the new regulations.

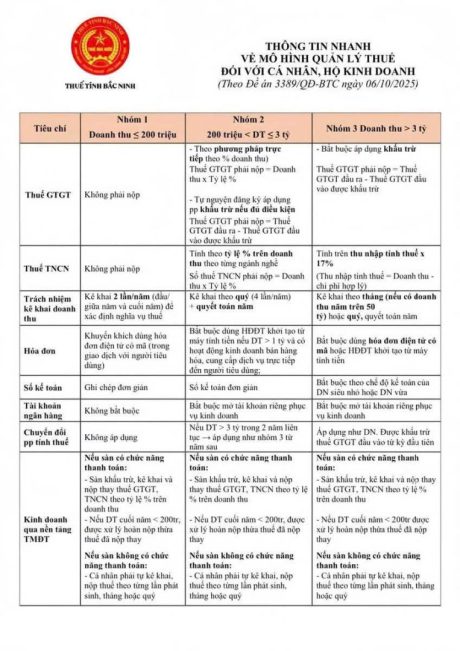

1. Overview of the Three Taxpayer Groups

Vietnam classifies household businesses into three groups based on annual revenue:

| Group | Annual Revenue | Tax Management Method |

| Group 1 | ≤ VND 200 million | Exempt from most taxes |

| Group 2 | VND 200 million – ≤ VND 3 billion | Direct method (percentage on revenue) |

| Group 3 | > VND 3 billion | Deduction method; full tax & accounting requirements |

2. VAT (GTGT) Obligations

Group 1 – Revenue ≤ 200 million

✔ No VAT payable.

Group 2 – Revenue 200 million to ≤ 3 billion

✔ VAT payable under the direct method (percentage on revenue)

✔ VAT = Revenue × Industry Percentage

✔ Optional deduction method if meeting conditions (e.g., invoice, valid accounting books).

Group 3 – Revenue > 3 billion

✔ Must apply the deduction method

✔ VAT payable = Output VAT – Input VAT deductible

✔ Must maintain proper accounting records and invoices.

3. Personal Income Tax (PIT/TNCN)

Group 1

✔ Exempt.

Group 2

PIT = Revenue × Industry Percentage (same as VAT direct method rules)

Group 3

PIT = Taxable Income × 17%

(Taxable Income = Revenue – Deductible Expenses)

4. Reporting Responsibilities

| Group | Reporting Requirement |

| Group 1 | Declare revenue twice per year (mid-year & year-end) |

| Group 2 | Quarterly declaration + annual finalization |

| Group 3 | Monthly declaration (or quarterly if eligible) + annual finalization |

5. Invoice Requirements

Group 1 – Optional invoices (recommended for consumer transactions).

Group 2 – Must issue electronic invoices for revenue > VND 200M/year or when required by business activity.

Group 3

– Mandatory e-invoicing with tax authority code.

– E-invoice activation required before issuing to customers.

6. Bookkeeping Requirements

| Group | Accounting Requirement |

| Group 1 | Simplified revenue book |

| Group 2 | Basic accounting books |

| Group 3 | Full accounting per Vietnam Accounting Standards (VAS) |

7. Bank Account Requirements

Group 1 ✔ Not mandatory.

Group 2 & 3

✔ Must open a dedicated business bank account.

✔ Mandatory for e-invoice registration, tax payments, and banking reconciliation.

8. Rules for E-Commerce (TMĐT) Sellers

Vietnam now has strict tax controls for online businesses.

- If the platform HAS payment processing (ShopeePay, TikTokShop Pay, LazadaPay): ✔ The platform withholds and pays taxes on behalf of the seller.

- If the platform DOES NOT handle payments (COD or social commerce): ✔ The seller must self-declare and pay taxes monthly or quarterly.

Special notes:

– If end-of-year revenue < 200M → eligible for tax exemption or refund.

– If revenue consistently exceeds 3B → recommended to convert to a company.

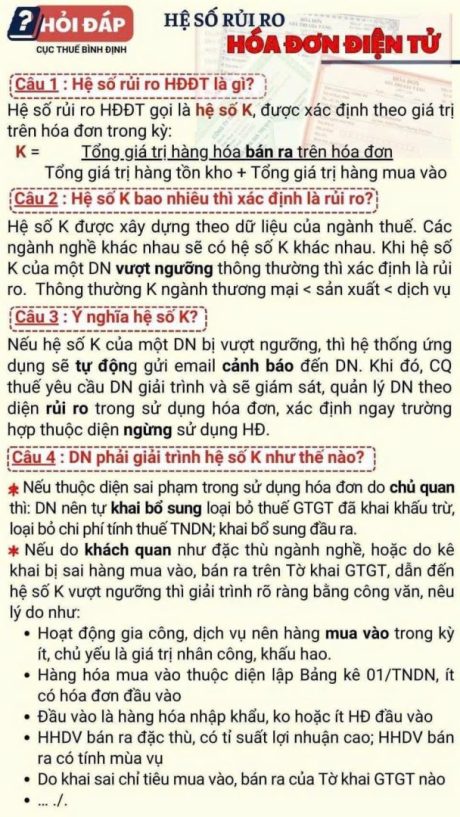

9. Risk Management: Invoice Risk Factor (K Index)

- The K-index measures tax risk based on the ratio: K = (Value of goods sold on invoices) / (Inventory + Purchases)

- When K exceeds the industry threshold:

- – The system automatically sends a warning email

- – The taxpayer may be required to explain discrepancies

- – High-risk taxpayers may be subject to invoice suspension

10. Meaning of the K-Index Warning

If your K-index exceeds the risk threshold:

- The tax authority will review your VAT declarations

- You may face inquiries regarding purchase/sale discrepancies

- Potential classification as high-risk taxpayer

- E-invoices may be temporarily suspended until explanation is accepted

11. How to Respond to a K-Index Warning (Professional Guidance)

Case 1 – Taxpayer error

✔ Amend VAT and PIT declarations

✔ Remove input VAT incorrectly claimed

✔ Adjust revenue/expense declarations accordingly

Case 2 – Objective/industry-specific reasons

Provide a written explanation such as:

- Seasonal activity or processing services with minimal input cost

- Import goods with minimal domestic invoices

- Sales of special goods with high profit margins

- Incorrect data from the e-commerce platform

- Inventory fluctuation due to long production cycles

12. Tax Rates by Industry (Direct Method)

| Industry | VAT % |

|---|---|

| Trading | 1% |

| Services | 5% |

| Manufacturing | 3% |

| Transport | 3% |

| Restaurants | 3% |

| Accommodation | 5% |

| Leasing | 5% |

| Industry | PIT % |

|---|---|

| Trading | 0.5% |

| Services | 2% |

| Manufacturing | 1.5% |

| Leasing | 5% |

| Transport | 1.5% |

Total Tax = VAT % + PIT %

13. Complete Tax Documentation Checklist (For Audit Readiness)

✔ Business registration

✔ Revenue and expense books

✔ Contracts and invoices

✔ Delivery notes, warehouse slips

✔ Bank statements

✔ E-commerce reports (Shopee, Lazada, TikTok)

✔ Monthly/quarterly tax returns

Keeping full documentation reduces audit risk and ensures compliance.

14. When Should a Household Business Upgrade to a Company?

You should transition when:

✔ Revenue consistently > 3 billion

✔ Signing contracts with corporate clients

✔ Need VAT invoices to claim input tax

✔ Want better access to bank loans

✔ Want to optimize legal tax planning

Benefits of corporate structure:

- Lower effective tax rate (especially for services)

- Full VAT deduction

- Enhanced business credibility

- Eligible for investment and scaling

15. Summary

Vietnam’s new tax management model aims to:

✔ Increase transparency

✔ Reduce tax fraud

✔ Improve e-commerce tax control

✔ Encourage proper bookkeeping

However, it requires:

⭐ Accurate declarations

⭐ Proper invoice usage

⭐ Full documentation

⭐ Professional compliance