🧾 Annual CIT Finalization Return

(Tờ khai thuế quyết toán thuế thu nhập doanh nghiệp – CIT)

💡 Understanding the Annual CIT Finalization Return

At the end of every fiscal year, enterprises in Vietnam are required to prepare and submit an Annual Corporate Income Tax (CIT) Finalization Return to the tax authorities. This return determines the company’s final tax obligations, reflecting actual profits, deductible expenses, and any adjustments or tax incentives.

Filing this declaration accurately and on time is a legal requirement under Vietnamese tax law. Failure to comply may result in administrative penalties, back taxes, or late payment fines — all of which can significantly impact business operations and financial credibility.

📘 Scope of Veritas Trust’s CIT Finalization Service

Our Annual CIT Finalization Return Service is designed to help enterprises complete the process with accuracy, compliance, and efficiency.

Our services include:

- Review and reconcile accounting books (general ledger, income, and expense accounts).

- Prepare CIT finalization forms according to official templates issued by the General Department of Taxation.

- Review deductible and non-deductible expenses in accordance with Decree 132/2020/NĐ-CP and Circular 78/2014/TT-BTC.

- Calculate tax payable based on actual income and applicable incentives.

- Represent clients during tax submission and clarification (if required by the Tax Authority).

- Provide advisory on how to optimize tax efficiency and ensure compliance in future fiscal years.

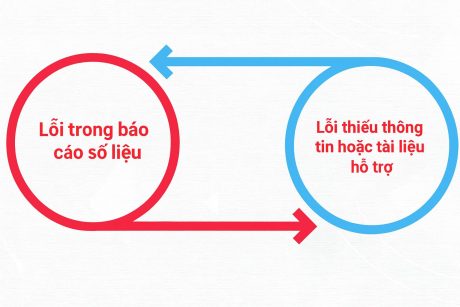

⚠️ Common Mistakes in CIT Reporting

- Data Errors in Financial Reports:

One of the most common issues is incorrect figures in accounting records or data input. This includes:

-

- Entering the wrong amounts from accounting systems.

- Using supporting documents that do not reflect the true nature or transaction value.

- Forgetting to declare or incorrectly declaring import/export taxes.

- Incorrect exchange rate conversion for foreign currency transactions.

Even small mistakes can cause major discrepancies between accounting reports and tax declarations, leading to audits or accusations of underreporting income.

- Missing Information or Supporting Documents

Incomplete or missing documents during tax filing can lead to tax authorities requesting additional clarification or even re-filing.

Common examples include:

-

- Missing salary registration tables or signed payroll sheets.

- Missing supporting schedules attached to the CIT return.

- Incomplete explanation for tax-deductible expenses.

- Ensuring sufficient documentation not only saves time but also protects businesses from future disputes.

🧩 Key Components of the CIT Finalization Dossier

A standard CIT finalization package typically includes:

- CIT finalization return – Form 03/TNDN

- Annual financial statements

- Appendices on business performance results

- Other related appendices

- Supporting documents for deductions, incentives, and reconciliation

⚙️ Step-by-Step Process of CIT Declaration

Step 1: Choose the Suitable CIT Declaration Method

Depending on the business nature, enterprises can choose between:

- Quarterly provisional declaration (Form 01A/01B-TNDN) – for enterprises with regular operations.

- Per-transaction declaration – for cases involving asset transfers, M&A, or project liquidation.

Step 2: Ensure Timely Submission and Payment

According to Vietnamese tax law:

- CIT provisional tax must be declared no later than the 30th day of the following quarter.

- Annual CIT finalization must be submitted within 90 days after the end of the fiscal year.

- The total provisional payment during the year must be at least 80% of the total annual CIT payable to avoid penalties.

💼 Veritas Trust’s CIT Finalization Service

Our Annual CIT Finalization Service provides comprehensive support from start to finish:

✅ Review and reconcile accounting books and tax records.

✅ Prepare and submit CIT forms in compliance with current tax regulations.

✅ Calculate final CIT payable and handle tax incentives or loss carryforwards.

✅ Represent clients in tax clarifications and communications.

✅ Provide recommendations to optimize tax efficiency and compliance.

💼 Why Choose Veritas Trust

- ✅ Comprehensive Expertise: Our team has deep knowledge of Vietnam’s tax regulations and accounting standards.

- 🔍 Risk-Free Filing: We ensure all documentation is accurate and compliant, reducing the risk of future audits.

- 💰 Tax Optimization: We help businesses identify lawful ways to minimize taxable income.

- 🕒 Time-Saving Process: We handle everything from data preparation to submission, allowing you to focus on business growth.

💵 Service Fee

One-off fee: 1,686,000 VND (~68 USD)

(Service fee excludes VAT)

Note: The service fee applies to entities with ≤200 transactions/year. Additional charges may apply for larger volumes or complex accounting structures.

🎯 Veritas Trust – Trusted Tax Compliance Partner

With Veritas Trust’s Annual CIT Finalization Return Service, businesses can confidently close their financial year, ensure compliance, and prepare for a stronger, more transparent financial foundation.

📌 Veritas Trust – Trust Built on Truth.