✅ ARTICLE 1 — Tax Risk Coefficient (K-Factor) for E-Invoices: Meaning, Calculation & How to Respond to Risk Alerts

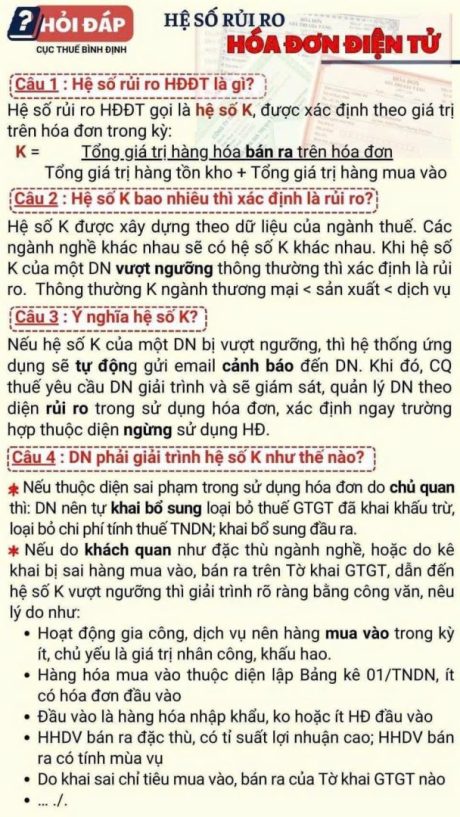

1. What Is the E-Invoice Risk Coefficient (K-Factor)?

The K-Factor is an indicator used by the Tax Authority to evaluate the risk level of a business when issuing e-invoices.

It is calculated based on the relationship between sales, purchases, and inventory within the reporting period.

📌 Formula for K-Factor:

K = Total value of goods sold on invoices ÷ (Inventory value + Purchase value)

This ratio allows tax authorities to assess whether the business has abnormal discrepancies in its purchasing and selling activities.

2. What K-Factor Level Is Considered “Risky”?

Each industry has its own acceptable K threshold.

When the K-Factor exceeds the industry threshold, the business is classified as high risk.

General trend:

- Commercial sector → lowest threshold

- Manufacturing → medium

- Service sector → higher threshold

If K exceeds the threshold, the tax system automatically issues a risk alert.

3. Why the K-Factor Matters

When a business exceeds the K threshold:

✔ The system automatically sends a warning email

✔ The business may be required to explain discrepancies

✔ The Tax Authority may monitor invoice usage more closely

✔ In severe cases, the business may be temporarily suspended from issuing invoices

The K-Factor helps prevent:

- Invoice fraud

- Artificially inflated sales

- Fake input invoices

- Incorrect VAT declarations

4. How to Explain a High K-Factor

📌 Case 1: Risk due to incorrect declarations

Businesses must:

- File supplementary VAT declarations

- Remove non-deductible VAT/TNDN expenses

- Correct invoices entered incorrectly

- Reconcile input – output data

📌 Case 2: Risk due to objective industry characteristics

If the business exceeds the K threshold due to operational nature, it must provide an official written explanation with reasons, such as:

- Outsourcing operations → high labor costs, low material purchases

- Purchases without invoices (e.g., Form 01/TNDN situations)

- Import-only businesses with few local invoices

- Seasonal goods with sudden increases in sales

- Mismatched entries on VAT declarations

A clear explanation helps avoid penalties and ensures continued invoice usage.

5. When Should Businesses Monitor the K-Factor Closely?

You should regularly monitor the K-Factor if your business is:

- Newly established

- Experiencing rapid revenue growth

- Having months where sales far exceed purchases

- Operating in import/export, outsourcing, or seasonal industries

Managing the K-Factor proactively helps avoid unnecessary tax risks.

📌 Conclusion

Understanding and monitoring the K-Factor is essential to avoid e-invoice suspension and tax penalties.

Businesses should adopt proper bookkeeping practices, reconcile data regularly, and submit timely explanations when needed.

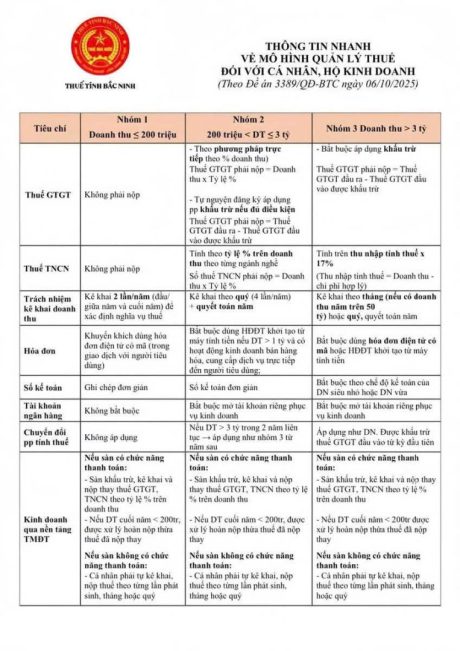

✅ ARTICLE 2 — Tax Risk Management System: How It Works & Why It Matters

The Tax Risk Management System is an automated framework used by the Tax Authority to classify businesses based on compliance behavior.

1. What the System Evaluates

- The system typically analyzes:

- K-Factor (sales vs purchases vs inventory)

- VAT declaration behavior

- Invoice issuance frequency

- Industry benchmarks

- Financial fluctuations

- History of violations

Each factor contributes to a risk score, which determines whether the business is low, medium, or high risk.

2. How Businesses Are Classified

Low Risk

✔ Good compliance history

✔ Stable input – output ratio

✔ No unusual declarations

Medium Risk

✔ Minor discrepancies

✔ Occasional late filings

✔ Inconsistent purchases or stock levels

High Risk

⚠️ Frequent amendments

⚠️ Abnormal sales/purchase ratios

⚠️ Invoice usage spikes

⚠️ Prior sanctions

High-risk businesses are subject to close monitoring.

3. Why the Tax Risk System Matters

It helps both the government and businesses:

- Detect invoice fraud early

- Prevent tax losses

- Improve transparency

- Ensure fair competition

- Reduce the risk of penalties

4. Measures to Improve Risk Ratings

Businesses can reduce risk by:

✔ Maintaining clean accounting records

✔ Ensuring accurate VAT declarations

✔ Monitoring inventory flow

✔ Using consistent invoice patterns

✔ Explaining anomalies promptly

✅ ARTICLE 3 — How to Avoid E-Invoice Risk Alerts

To avoid risk alerts, businesses should implement the following:

1. Maintain Consistent Input–Output Ratios

- Keep records aligned with actual business operations.

- Avoid months where input invoices are too low compared to output.

2. Reconcile Inventory Regularly

Compare:

- Physical stock

- Accounting inventory

- VAT declarations

Any mismatch can trigger a risk alert.

3. Declare VAT Correctly and On Time

Late submissions or frequent supplement declarations can raise risk scores.

4. Avoid Sudden Spikes in Invoice Issuance

If sales increase significantly:

✔ Provide proper documentation

✔ Ensure inventory and purchases support the numbers

5. Keep Complete Supporting Documents

Missing documents = high risk.

Examples:

- Contracts

- Delivery notes

- Payment evidence

- Import documents

✅ ARTICLE 4 — How to Write a Professional Explanation Letter for the Tax Authority

When the Tax Authority requests clarification, businesses should prepare a professional explanation letter.

1. Structure of an Effective Letter

1.1. Introduction

- Reference the tax authority’s request

- State the reporting period

- Confirm your cooperation

1.2. Explanation of the Issue

- Describe why K-Factor exceeded threshold

- Provide quantitative evidence

- Mention special business characteristics

1.3. Supporting Documents

Attach:

- Inventory reports

- Purchase/sales records

- Contracts & invoices

- Import documentation

- Internal accounting reports

1.4. Commitment

State that:

- Information is accurate

- Business will adjust processes

- Compliance will be strengthened

2. Best Practices

✔ Use official, respectful wording

✔ Provide clear data tables

✔ Avoid emotional language

✔ Explain objectively with figures

✔ Submit on time

A professional explanation helps avoid penalties and ensures smooth operations.